You’re choosing between SBI Cashback and Jupiter Edge+, but headline percentages hide caps, exclusions, and partner lists, making it hard to know who actually pays more each month.

Misreading just one rule (like a monthly cap or an excluded category) can cut your real cashback by hundreds of rupees, even when your total spend is the same.

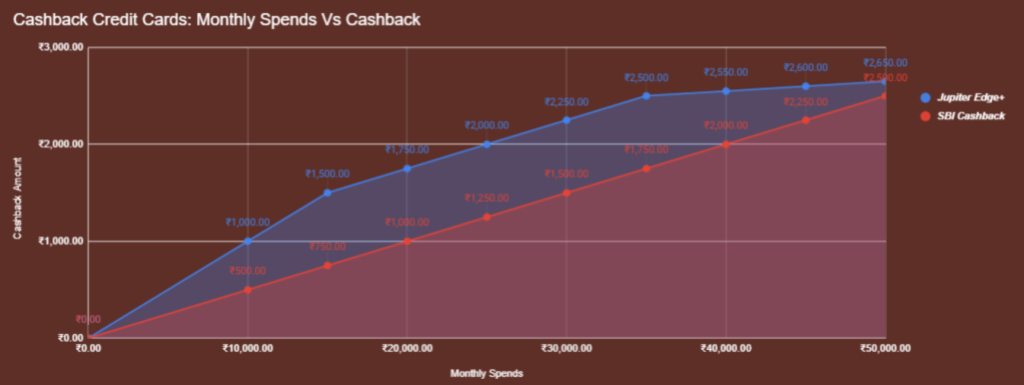

We ignore the marketing of ‘% cashback’ and compare rupees back per month across ₹10k–₹50k mapping the fine print so you can manage your spends and maximize net cashback with either card.

- Jupiter Edge+ returns more cashback than SBI Cashback at every slab from ₹10,000 to ₹50,000

- Mechanically, Edge+ leans on 10% shopping partners and 5% travel partners (with monthly caps), UPI on credit, and Jewels (5 Jewels = ₹1). SBI Cashback pays a straight 5% on online and 1% offline with broad exclusions; joining/renewal fees apply with a spend-based fee reversal rule.

Monthly Spends vs Cashback

| Monthly Spends | SBI Cashback | Jupiter Edge+ | Who wins? |

| ₹0 | ₹0 | ₹0 | – |

| ₹10,000 | ₹500 | ₹1,000 | Edge+ by ₹500 |

| ₹15,000 | ₹750 | ₹1,500 | Edge+ by ₹750 |

| ₹20,000 | ₹1,000 | ₹1,750 | Edge+ by ₹750 |

| ₹25,000 | ₹1,250 | ₹2,000 | Edge+ by ₹750 |

| ₹30,000 | ₹1,500 | ₹2,250 | Edge+ by ₹750 |

| ₹35,000 | ₹1,750 | ₹2,500 | Edge+ by ₹750 |

| ₹40,000 | ₹2,000 | ₹2,550 | Edge+ by ₹550 |

| ₹45,000 | ₹2,250 | ₹2,600 | Edge+ by ₹350 |

| ₹50,000 | ₹2,500 | ₹2,650 | Edge+ by ₹150 |

Monthly spends and cashback: SBI Cashback Credit Card Vs Jupiter Edge+

What this implies: As your spend climbs, Edge+’s gives maximum cashback, while SBI’s 5% online keeps compounding with spends, hence the shrinking gap. In our mix, though, Edge+ still wins at every tier.

Jupiter Edge+ and SBI Cashback Credit Card overview

Jupiter Edge+ (CSB Bank RuPay Credit Card)

- Rewards structure: 10% on shopping partners, 5% on travel partners, 1% on other eligible spends. Jewels credited instantly; 5 Jewels = ₹1; redeem as cash equivalents, bills, gift cards, etc. UPI on credit (scan any QR via RuPay).

- Caps: No overall max on 1%, but accelerated categories are capped: 10% up to ₹1,500 per cycle (₹500 per-merchant sub-cap); 5% up to ₹1,000 per cycle; 1% no limit.

- Fees/offer: ₹499 + GST one-time joining fee (limited-period banner); lifetime free (no annual fee); current promotion shows 1-year Amazon Prime + Fraud Protect. Check the live page before applying.

SBI Cashback Credit Card

- Rewards structure: 5% cashback on online spends* (no merchant restriction), 1% on offline. Auto-credit after statement; see exclusions list (e.g., utilities, insurance, fuel, rent, wallet loads, education, railways, EMIs).

- Fees/waiver: ₹999 joining; ₹999 renewal from year 2; renewal fee reversed at ₹2,00,000 annual spend. Fuel surcharge waiver terms apply (₹100 cap per cycle on eligible transactions). Always confirm current T&Cs.

Why Edge+ leads in cashback?

- Higher accelerators, when you can hit them. If a big chunk of your monthly spend lands on Edge+’s partner list (Amazon, Flipkart, Myntra, Ajio, Zara, Nykaa, Croma, Reliance Trends/Digital, Tata CLiQ for 10%; Make My Trip/Ease My Trip/ Yatra/ Cleartrip for 5%), your effective rate spikes.

- UPI on credit reduces “wasted” QR spends. Paying by QR while still earning credit-card rewards helps keep more of your routine payments in the rewardable bucket (issuer rules apply).

- SBI’s simplicity shines at scale. A flat 5% online with wide acceptance keeps accruing as your spend rises, which is why the gap narrows at ₹40k–₹50k in your sheet. But in your specific mix, it doesn’t overtake Edge+.

How to maximise either card (practical playbook)

If you carry Jupiter Edge+

- Sequence your month:

- Route shopping to partners till the 10% cap (₹1,500; ₹500 per-merchant)

- Fill the travel cap (₹1,000 at 5%)

- Push the rest to 1% (no cap)

- Use UPI on credit for QR payments to avoid missing rewards.

- Redeem Jewels (5 = ₹1) toward cash equivalents/bills when convenient.

If you carry SBI Cashback

- Make online = 5%: prefer online checkouts for eligible merchants to maximise the 5%.

- Know the exclusions (utilities, fuel, rent, wallet loads, EMIs, education, railways, etc.) to avoid over-estimating earnings.

- Hit ₹2L annual spend if you want the renewal fee reversal in year 2+.

Who should pick which?

- Pick Jupiter Edge+ if you regularly shop on the named partners, book travel on the listed OTAs, want UPI on credit, and like the current LTF + Prime positioning. That pattern explains why Edge+ wins each slab.

- Pick SBI Cashback if your spend is broadly online but not necessarily on Edge+’s partner list, you value a simple 5%/1% model, and you’re okay with the ₹999 fee structure (with potential fee reversal at ₹2L annual).

FAQ

Does Jupiter Edge+ have a hard monthly cap on total cashback?

No overall cap on 1%, but accelerated categories are capped: 10% up to ₹1,500 (₹500 per-merchant) and 5% up to ₹1,000 per cycle.

How is Edge+ cashback credited and redeemed?

As Jewels credited instantly; 5 Jewels = ₹1; redeem for cash equivalents, bills, gift cards, etc.

What are SBI Cashback’s key exclusions and fees?

SBI lists online 5% / offline 1% with exclusions (utilities, fuel, rent, wallet, education, railways, EMIs, etc.). Fees: ₹999 joining, ₹999 renewal, with renewal reversed at ₹2L annual spend; fuel surcharge waiver terms apply.