In today’s dynamic and competitive real estate market, property investors and asset managers are constantly seeking ways to maximize ROI, minimize vacancies, and stay ahead of emerging trends. Traditional methods of real estate portfolio management, often reliant on manual data collection and reactive decision-making, are no longer sufficient to deliver optimal results.

Enter Predictive Portfolio Management powered by AI, a game-changing approach that harnesses the power of artificial intelligence to transform how real estate portfolios are analyzed, managed, and optimized.

What Is Real Estate Portfolio Management?

Real estate portfolio management involves the strategic oversight and optimization of a collection of property investments. This includes:

- Evaluating asset performance

- Allocating capital across property types and locations

- Minimizing risks and vacancies

- Ensuring a strong return on investment (ROI)

The goal is to maintain a well-diversified, high-performing portfolio that aligns with investment objectives.

The Role of AI in Real Estate Portfolio Management

Artificial Intelligence (AI) is revolutionizing the real estate industry by providing predictive insights that were previously impossible to obtain in real time. Instead of relying solely on historical performance or gut instinct, AI empowers investors and property managers to make data-driven decisions with enhanced accuracy and speed.

Key Capabilities of AI in Real Estate Portfolio Management:

- Predicting ROI (Return on Investment)

- Forecasting Vacancy Rates

- Identifying Market Trends and Shifts

- Optimizing Property Mix

- Detecting Risks Early

Let’s dive into each of these.

1. Predicting ROI with AI Algorithms

AI analyzes vast datasets — including market trends, location analytics, tenant behavior, and even social sentiment — to estimate the future performance of individual assets or entire portfolios.

How AI Forecasts ROI:

- Rental Income Prediction: Based on comparable properties, rental trends, and local economic indicators.

- Expense Optimization: By tracking maintenance cycles, utility costs, and vendor performance.

- Value Appreciation Analysis: AI for real estate models can predict when and where property values will rise based on urban development, population growth, or zoning changes.

This enables smarter investment decisions and helps avoid underperforming assets.

2. Forecasting Vacancy Rates with Predictive Models

Vacancies can cripple portfolio performance. AI minimizes this risk by predicting vacancy rates before they happen.

AI Insights Include:

- Lease Expiry Patterns

- Tenant Satisfaction Analysis (using sentiment from reviews and support interactions)

- Competitor Activity in the Area

- Supply vs. Demand Ratios

With this foresight, property managers can proactively offer incentives, adjust marketing strategies, or schedule renovations to reduce downtime.

3. Identifying Market Trends in Real-Time

Markets shift rapidly due to external forces like interest rates, local economies, or even global events. AI constantly monitors and analyzes these changes to provide actionable alerts.

AI Can Detect:

- Emerging Neighborhoods Before They Boom

- Declining Areas Before Values Drop

- Changing Demographics

- Shifts in Commercial vs. Residential Demand

This ensures portfolio decisions are proactive rather than reactive.

4. Dynamic Asset Allocation & Optimization

AI tools can recommend optimal allocation of capital across different properties and asset classes — based on performance, risk tolerance, and market conditions.

For example:

- Move funds from low-performing residential units to high-growth commercial spaces.

- Reallocate budgets toward eco-friendly upgrades if the data suggests an ROI boost from green-certified buildings.

5. Early Risk Detection

AI models can flag potential risks far earlier than traditional analysis. These might include:

- Rising crime rates in an area

- Signs of economic downturn

- Shifts in lending policies

- Natural disaster risks (based on climate data)

By detecting these early, real estate professionals can mitigate losses and safeguard assets.

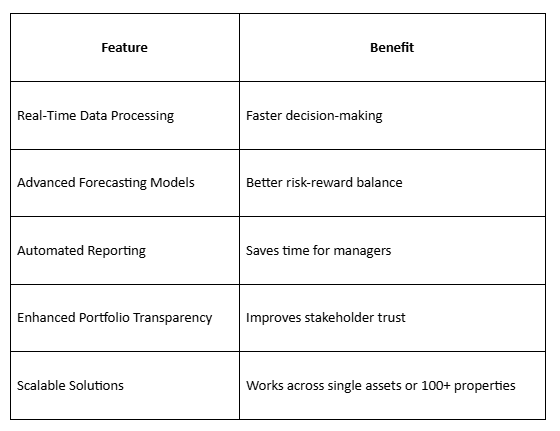

Benefits of Using AI in Predictive Portfolio Management

Real-World Application: AI at Work in Real Estate

Many leading property firms are now using AI-powered platforms to:

- Automate rental pricing strategies

- Determine the best timing for property sales

- Predict renovation ROI

- Monitor tenant retention trends

Even private investors and small portfolio owners are adopting AI-as-a-Service tools to gain a competitive edge.

Meet Leni: Your AI-Powered Real Estate Assistant

If you’re exploring how to bring AI into your real estate strategy, Leni is a powerful assistant designed to help real estate pros simplify and optimize their operations.

What Leni Offers:

- Predictive Analytics for ROI and Occupancy

- Smart Alerts for Market Changes

- Automated Portfolio Reports

- Visual Dashboards to Track Performance

Leni helps you stay ahead of the curve, spot growth opportunities, and make confident, intelligent decisions, all with a few clicks.

Conclusion

AI is no longer a luxury in real estate portfolio management, it’s a necessity for those looking to maximize returns, reduce risk, and outpace competitors. Predictive portfolio management allows real estate professionals to look beyond spreadsheets and into the future with clarity.

With tools like Leni, real estate teams can streamline operations, drive smarter decisions, and unlock the full potential of their portfolios.

Book your demo today