P2P Payment Market Scope and Overview

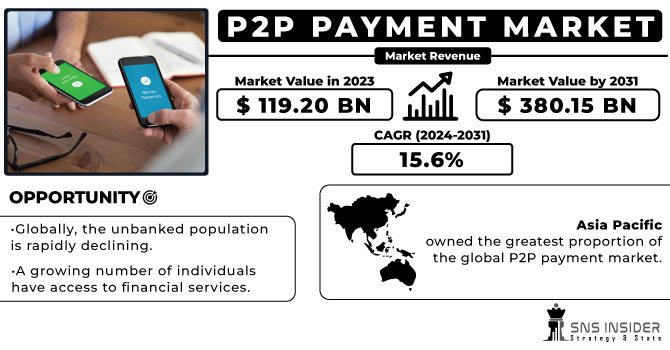

The P2P Payment Market size was valued at USD 119.20 Billion in 2023 and it is expected to reach USD 380.15 Billion by 2031 and grow at a substantial Compound Annual Growth Rate (CAGR) of 15.6% over the forecast period 2024-2031.

The P2P payment market is experiencing explosive growth fueled by the increasing popularity of mobile wallets and the growing preference for digital transactions over cash.

The rising penetration of smartphones, coupled with the growing comfort level with digital transactions, is propelling market growth. Additionally, the increasing popularity of online marketplaces and social commerce is creating new avenues for P2P payments. Moreover, millennials and Gen Z, who are digital natives, are driving the demand for faster and more convenient payment methods.

Furthermore, government initiatives promoting financial inclusion and cashless economies are creating fertile ground for P2P payment platforms. As these platforms offer lower transaction fees compared to traditional methods, they are particularly attractive to unbanked and underbanked populations.

Key Players:

- Alibaba

- Apple

- Circle International Financial Limited

- Google LLC

- One97 Communications Limited

- PayPal Holdings

- Square

- WePay

- Wise Payments Limited

- Zelle

- Other Players

Market Segmentation Analysis

By Transaction Mode: Mobile web payments currently dominate the market in 2023 due to the ubiquitous presence of smartphones and the ease of use offered by mobile apps. However, Near Field Communication (NFC) technology is gaining traction as it facilitates contactless payments and growing at a faster rate.

By Payment Type: Remote payments are the most popular type, allowing users to send and receive money from any location. However, proximity payments are expected to grow significantly due to the increasing adoption of NFC technology.

By End User: The personal segment is the current leader, with individuals of all age groups utilizing P2P platforms for various purposes, including splitting bills, sending gifts, and making online purchases. However, the business segment is projected to witness significant growth as businesses leverage P2P platforms for faster and more efficient transactions.

Market Segmentation and Sub-Segmentation Included Are:

By Transaction Mode:

- Mobile Web Payments

- Near Field Communication

- SMS/Direct Carrier Billing

- Others

By Payment Type:

- Remote

- Proximity

By End User:

- Personal

- 18 to 30 Year

- 31 to 54 Year

- 55 to 73 Year

- Business

By Application:

- Media & Entertainment

- Energy & Utilities

- Healthcare

- Retail

- Hospitality & Transportation

- Others

Key Regional Developments

Asia Pacific currently holds the dominant position in the global P2P payment market, and this trend is expected to continue. The region boasts a large and tech-savvy population, coupled with a growing number of innovative FinTech solutions. Countries like China and Indonesia are leading the way in P2P payments adoption, driven by factors such as a high smartphone penetration rate and limited access to traditional banking services.

Recent Developments in the P2P Payment Market

- June 2024: Apple, a leading mobile phone manufacturer, unveiled its “Tap to Cash” feature. This innovative solution allows iPhone users to transfer money simply by holding their phones together, further simplifying P2P transactions.

- December 2023: Visa collaborated with RevoluPAY to launch Visa Direct, a new service that empowers RevoluPAY users to send and receive money instantly via RevoluSEND. This collaboration leverages Visa’s global network and RevoluPAY’s technology, catering to the growing demand for seamless digital payments.

- June 2023: Squarelaunched Cash App for Business which allows businesses to accept payments directly through the Cash App, expanding their reach to the Cash App’s user base.

- May 2024: PayPalintroduced the Zettle Terminal 2 which offers faster processing times and improved security features, making it a more efficient and reliable solution for in-person transactions.

- April 2024: Venmolaunched Venmo for Business which caters to businesses by enabling them to create invoices and manage customer payments directly through Venmo.

Key Takeaways

- The report will help you understand which segments within the P2P payment market are experiencing the most significant growth and offer the most investment potential.

- By analyzing future growth trends and technological advancements, you can anticipate future market needs and develop innovative P2P payment solutions.

- The report provides valuable information on key players and their strategies, allowing companies to refine their business approach and gain a competitive edge.

- With comprehensive market analysis and insights, you can make well-informed decisions about entering the P2P payment market or expanding your existing presence.

Factors such as the increasing adoption of smartphones, rising internet penetration, and growing acceptance of digital payments will propel market growth. Furthermore, the combination of blockchain technology and artificial intelligence has the potential to significantly transform the P2P payment industry.

Table of Contents

- Introduction

- Industry Flowchart

- Research Methodology

- Market Dynamics

- Impact Analysis

- Impact of Ukraine-Russia war

- Impact of Economic Slowdown on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Global P2P Payment Market, by Transaction Mode

- Global P2P Payment Market, by Payment Type

- Global P2P Payment Market, by End User

- Global P2P Payment Market, by Application

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

CAD and PLM Software Market Analysis

Natural Language Processing Market Forecast

Quantum Computing Market Research

Travel and Expense Management Software Market Overview