Stop Loss Insurance is a type of coverage that protects employers who self-fund their employee health benefits by limiting their financial risk. The growth of the stop loss insurance market is inspired by the increasing number of employers transferring to self-funded health plans to better control health care and achieve flexibility. Increasing incidence of high-cost medical claims has further increased the demand for financial security through stop loss coverage. Additionally, insurers are increasing their offerings with advanced analytics and digital tools, leading to more tail and efficient solutions that support risk management and financial stability for employers.

Key Growth Drivers and Opportunities

Expansion of Third-Party Administrators (TPAs): Third party administrators are an essential part of the management of self-funded employee health plans through their services of claims processing, benefits administration, and risk assessment. As TPAs continue to multiply, local small and medium-sized employers, who may not have in-house expertise, are given more choices to bring in customized stop loss solutions. Through reorganizing the activities and making the processes more straightforward, TPAs support the insurance companies and businesses in handling the high-cost claims more quickly and economically which, as a result, increases the trust in self-funding and the need for the stop loss insurance coverage.

Challenges

High premiums and complicated policy structures are a couple of the downers in the market of Stop Loss Insurance that can be hard for smaller employers to understand and be economically unviable at the same time. A lack of knowledge about self-funded insurance and stop-loss benefits on the part of employers may or may not be the reason for the low take-up rates especially in those markets where the employer is not a corporate entity or where there are hardly any services provided to the employers.

Moreover, stop loss insurance, with various coverage terms and regulations across different areas, along with the likelihood of postponed payments or claim disagreements, can give rise to operational challenges. These challenges may then be the reason some companies are reluctant to adopt the insurance coverage in full, thereby undoing the benefits of risk transfer.

Innovation and Expansion

Arlo and Nationwide Introduce a Stop Loss Insurance Option for Small Businesses

In October 2024, in their capacity as managing general underwriter, Arlo will make use of cutting-edge technologies to increase Nationwide’s medical stop loss market share among small businesses. A new medical stop loss agreement between Nationwide and Arlo will provide small companies choices to assist them better control costs as more of them use level-funded healthcare plans to reduce employee health plan spending.

As Nationwide expands its robust medical stop loss insurance presence and capabilities, Arlo will work as a managing general underwriter (MGU) for the firm, offering a level-funded stop loss solution specifically designed for small companies.

BCS Financial Introduces Tailored Stop Loss Protection for Gene Therapy Expenses

In October 2024, for small to mid-sized self-funded employer groups looking for further protection against gene therapy expenses, BCS Financial introduced a new stop loss instrument. The product, called Stop Loss GTS, is intended to be used in conjunction with conventional stop loss coverage to offer extra risk protection against unanticipated and unheard-of gene therapy expenses.

The product reduces the risk of lasering and non-renewals on their traditional stop loss policy and gives self-funded employer groups the option to “carve out” the costs of the gene therapy ingredient in a separate stop loss policy, protecting them against the therapy costs themselves. Forty-five states presently offer the product for quotation.

Inventive Sparks, Expanding Markets

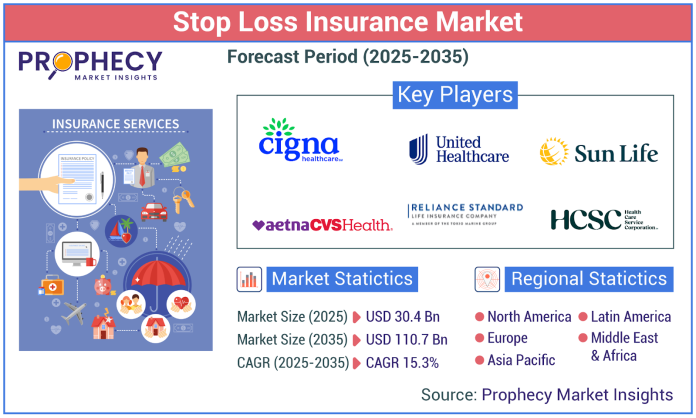

The usage of Al in underwriting, collaboration with brokers, offering flexibility in plans, reaching out to new locations, and communicating the status of self-funded benefits to employers are the primary steps in the development of Stop Loss Insurance business. The stop loss insurance market is the realm where leading companies such as CIGNA, UnitedHealth, Highmark, Elevance Health (Anthem), Reliance Standard (Tokio Marine), and other companies operate.

About Author:

Prophecy is a specialized market research, analytics, marketing and business strategy, and solutions company that offer strategic and tactical support to clients for making well-informed business decisions and to identify and achieve high value opportunities in the target business area. Also, we help our client to address business challenges and provide best possible solutions to overcome them and transform their business.