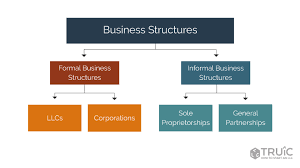

Every business needs to follow a certain structure according to a Gilbert AZ attorney. A business legal structure, or business entity, is a classification provided to businesses by the government and governs certain aspects of their business. On the federal level, a business’s legal structure has tax implications. At the state level, it affects liability. The most important aspects of entity structure in the US are its advantages and disadvantages in helping the business function smoothly.

Business Structure Types

The types of structures available for businesses are:

1. Sole Proprietorship

It is the most straightforward form of business, consisting of one person who manages it daily. Considering the taxation of the business, its revenues and expenditures are incorporated in the proprietor’s tax returns.

Although they engage in business activities, the individual is not required to file other income tax forms for the business entity as there is no legal business from the owner. The individual does file Form 1040, which will require particular schedules to be attached, such as Schedule C and Schedule SE, for self-employment tax purposes.

2. Partnership

A ‘partnership’ is another business organizational structure that brings together two or more persons as owners. It is the simplest form of a business structured when the number of owners is as low as two. A partnership has numerous features that resemble a sole proprietorship. For instance, the business does not provide for membership from the owners in its constitution; thus, the owner and business remain one person in the eyes of the law.

In the case of a partnership, the profits and losses of the partnership are reported on the individual partner’s tax return as though the partner has received them and losses for tax years, and each partner attaches Form 1065 to their tax return and files it. Further, self-employment tax, as such, is assessed where the earnings or profits of each partner in the partnership exceed the amount of the enterprise’s taxable income and are based on each partner’s share of the organization’s profits. This must also include the K-1 form, which summarizes income or loss.

3. Corporation

A corporation is a business organization that allows its owners to have limited liability due to its incorporation. It is detailed and quite costly to initiate, and it demands that the shareholders adhere to stricter tax laws and other statutory requirements. Most companies seek the services of lawyers to facilitate registration and ensure that the organization adheres to the laws of the domicile state.

Before an organization can issue shares of common stock, it must first be transformed into a corporation and only then be able to go public. Corporations are taxable at the federal and state levels, and shareholders must report their dividends when they file individual income tax returns.

C-corporation and S-corporation are the primary categories of businesses under this organizational form. A C corporation is a corporation that exists irrespective of the owners, while an S corporation has a limited number, like a partnership, that does not legally separate the owners.

4. Limited Liability Company (LLC)

A limited liability company (LLC) is a business structure that offers the advantages of both partnerships and corporations. It protects the investor’s assets from the company’s debts and limits taxation and business overhead. The company’s profits and losses flow onto its owners and are taxed on this share of the profits or losses claimed in the income tax return.

Conclusion

These are various types of entities and how to tackle the question of the appropriate legal form for the business. All structures are different, and the first step toward becoming a successful business is understanding how to turn these advantages into features.

References:

- https://bbcincorp.com/offshore/articles/how-to-choose-business-structure

- https://corporatefinanceinstitute.com/resources/management/business-structure/

- https://www.businessnewsdaily.com/8163-choose-legal-business-structure.html