When a traveling activation hits five cities in three weeks, the margin for error on operational execution is close to zero. One missing brand ambassador can reverberate into holdups at the next stop too, according to Event Staff, which orchestrates 300,000 guest interactions a year nationwide at U.S. festivals and corporate tours. A no-show in Phoenix, for instance, can set off a domino effect in Denver and a permitting hiccup in one market can leave equipment stranded two stops later.

For marketing executives running multi-city campaigns, the question isn’t whether something will break—it’s whether your multi-city tour staffing infrastructure can absorb the impact without failures becoming visible to guests.

The Hidden Cost of Tour Fragmentation

Most national brands approach touring logistics as a series of discrete local events. They hire city-by-city, brief teams separately, and hope regional contractors maintain quality parity. The result: inconsistent guest experiences, duplicated training costs, and zero institutional memory between markets.

Staffing is a large variable cost in event planning, including wages, benefits and associated costs. These costs vary depending on the length, scope and location of the event.

For instance, in nonprofit events, multi-city tour staffing costs are considered variable expenses that depend on attendance and other factors

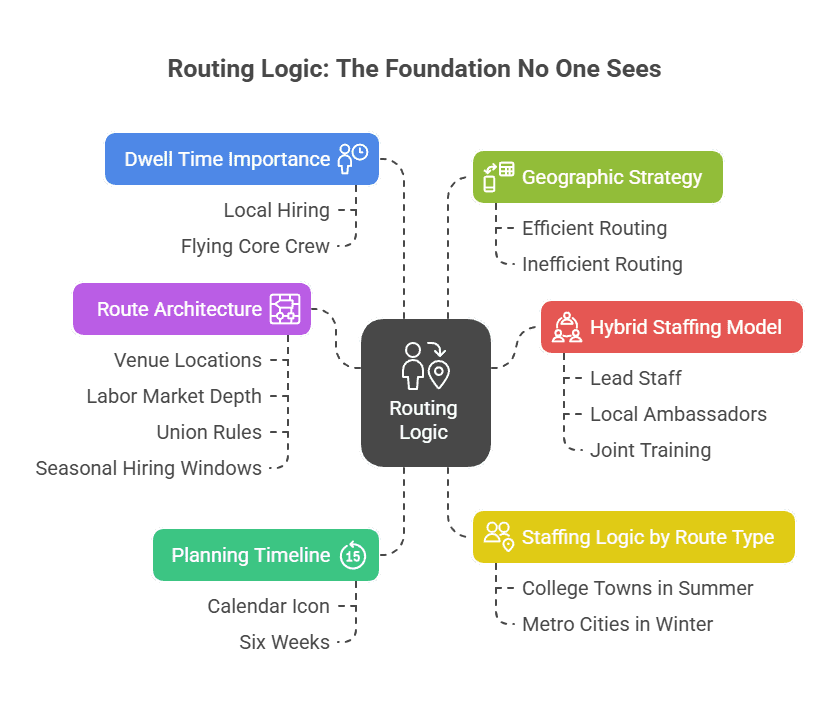

Routing Logic: The Foundation No One Sees

Effective multi-city tour staffing begins six weeks before launch, during route architecture. Smart operators map not just venue locations but labor market depth, union jurisdictions, and seasonal hiring windows. A summer route through college towns requires different recruiting lead times than a winter route through metro markets.

Dwell time matters more than mileage. A tour stop needs a minimum 48-hour market presence to justify local hiring and training investment. Anything shorter and you’re better served flying a core crew between cities.

For stops lasting three to seven days, hybrid models work: transport 3-4 lead staff for continuity, hire 15-20 local brand ambassadors for volume, and ensure both groups train together on-site for the first shift.

Geography creates natural testing grounds. EventStaff’s national event staffing network builds routing models that account for time zone fatigue, vendor overlap between adjacent markets, and realistic travel buffers. A West Coast swing through Seattle, Portland, and San Francisco allows shared vendor relationships and crew familiarity. Jumping from Miami to Minneapolis mid-tour introduces unnecessary friction.

Vendor / Union Coordination

Multi-city tours cut across dozens of local jurisdictions, each with its own set of permitting requirements, union rules and insurance thresholds. In Chicago, load-in for any venue over 10,000 square feet is overseen by IATSE Local 2.

In Las Vegas, Culinary Workers Union Local 226 has jurisdiction over sampling and food service activations on certain properties. Ignoring these boundaries doesn’t just create labor friction—it can halt an activation mid-shift.

Experienced tour operators maintain a living database of union windows by market. A typical festival season window in Miami runs from February through April; in Austin, it’s March and October. Scheduling tour stops during high-demand windows increases crew costs by 20-40% and reduces available talent. Route planning should map union calendars as carefully as venue availability.

Vendor redundancy is non-negotiable. A single national AV vendor sounds efficient until their truck breaks down in Omaha. Tier-one tour operations maintain relationships with at least two qualified vendors per category (AV, power, structures) in each target market, with pre-negotiated rates and confirmed backup availability.

Shift Redundancy: Building Margin Into the Schedule

The standard touring mistake: staffing exactly to need. If an activation requires eight brand ambassadors per shift, inexperienced operators hire eight. Then one calls out sick, another gets stuck in traffic, and the entire experience degrades visibly.

Resilient tour multi-city tour staffing models build 20-25% redundancy into every shift. For that eight-person activation, hire ten local staff, rotate them through shifts, and maintain two on-call floats. The cost delta is minor—usually 15-18% of total labor spend—but the risk mitigation is profound.

When a team member in Dallas has a family emergency, you’re not scrambling through Craigslist at 6 AM.

Cross-training transforms redundancy from a cost center to a capability multiplier. Brand ambassadors should understand product demonstration and crowd flow management. Lead staff should be able to step into registration or runner roles. This flexibility means a smaller crew can handle larger volume spikes without visible strain.

Communication Architecture: The Tree That Holds Everything

Most tour communication fails because it’s too flat. Everyone emails everyone, information scatters across threads, and in-market teams never know which instruction is current. By stop three, you’re playing telephone across four time zones.

Effective tour operations use a three-tier communication tree:

| Tier 1: Tour Director — single point of truth for brand standards, routing decisions, and vendor escalations. This person travels the full circuit and maintains continuity. Tier 2: Market Leads — local site captains responsible for team briefings, daily operations, and real-time problem solving. One per city, reporting directly to the Tour Director. Tier 3: Shift Supervisors — frontline staff managers handling 6-8 brand ambassadors per shift, feeding hourly status updates to Market Lead. |

Information flows down through tiers; exceptions flow up. No lateral chatter between cities unless the Tour Director authorizes it. This structure sounds rigid, but it prevents the chaos of 40 people trying to solve the same problem simultaneously while the clock runs.

Technology backbone: Use a single shared platform for schedules, contact lists, and site documentation. Google Workspace and Airtable work for smaller tours. Larger operations use specialized tools like Planning Pod or EventMobi. The platform matters less than the discipline: one source of truth, updated in real time, accessible offline.

The Salt Lake City Variable: When Local Context Rewrites the Plan

Salt Lake City illustrates why cookie-cutter tour planning fails. The market appears straightforward—clean downtown venues, strong convention infrastructure, educated workforce—but it carries invisible complexity.

- Elevation and exertion affect staffing in ways coastal planners miss. At 4,226 feet, Salt Lake sits high enough that out-of-state crew members often underperform on day one. Load-in teams tire faster, brand ambassadors lose vocal energy by mid-afternoon, and hydration needs double. Smart tour logistics for large events in Salt Lake City account for this by scheduling lighter first-day shifts and building extra rest periods into multi-day activations.

- Cultural calendar creates unexpected blackout periods. MLM company conventions dominate downtown hotels from late January through March, absorbing thousands of temporary workers and inflating hourly rates 30-40%. Plan a tour stop during that window and you’re competing with four simultaneous product launches for the same labor pool. Conversely, the post-Sundance lull in February offers deep crew availability and favorable venue rates.

- Liquor licensing complicates sampling activations. Utah’s 5% ABV cap on draft beer and prohibition on happy hour pricing means any alcohol-involved brand activation requires special event permits filed 30-60 days in advance. Tours that include spirits sampling need licensed servers—a smaller labor pool with limited weekend availability.

Local multi-city tour staffing partners with SLC market knowledge to navigate these constraints invisibly. Out-of-state tour operators who skip this step usually discover the problems mid-setup, when solutions cost three times as much.

Cross-City Quality Assurance: The Checklist That Scales

Consistency across markets requires more than good intentions—it demands systematic QA checkpoints that survive crew turnover and time zone chaos.

Pre-arrival audit (72 hours before market entry):

- Confirm all local hires have completed digital onboarding

- Verify venue access, load-in windows, and utility hookup locations

- Test the communication tree with the full market team

- Review city-specific permitting, union requirements, and insurance certificates

Day-one walkthrough (first shift, every market):

- Tour Director and Market Lead physically review the setup together

- Photograph brand standard compliance for documentation

- Run a 15-minute team briefing covering the tour context, not just local tasks

- Determine site conditions (weather exposure, ADA access, emergency exits)

Daily debrief (end of shift):

- Market Lead submits written summary: attendance, incidents, guest volume, supply levels

- Tour Director flags patterns (are we burning through swag faster than projected? Are certain talking points confusing guests?)

- Shift Supervisors note individual performance trends

Post-market retrospective (within 48 hours of teardown):

- What worked here that we should replicate in the next city?

- What broke that we need to fix systemically?

- Did local vendors perform to standard? Document for future routing decisions.

This cadence feels bureaucratic until something goes wrong. Then it becomes the only reason you can diagnose whether a problem originated in staffing, training, venue conditions, or product supply—and whether it’s likely to repeat in the next market.

What Separates Functional from Forgettable

The tours that marketing executives remember fondly share a common trait: operational invisibility. Brand ambassadors arrive early, look cohesive, and speak confidently. Logistics flow without drama. When problems surface, they’re resolved before guests notice.

That invisibility requires visible investment in the systems most brands skip: centralized staffing coordination, market-specific intelligence, communication discipline, and ruthless attention to redundancy.

It costs 12-18% more than the lowest-bid approach. It also eliminates the late-night crisis calls that define the alternative.

For brands running multi-city tours, the operational question is binary: build infrastructure that scales, or absorb preventable failure. The choice shows up in guest experience, staff retention, and whether your team is excited or exhausted when they reach the final market.