In the high-stakes environment of prop firm trading, adhering to strict drawdown and position management rules is critical for success. Recent data shows that over 68% of failed prop firm challenges are due to breaching risk parameters rather than poor market analysis.

With firms like FTMO, MyForexFunds, and The Funded Trader enforcing rigorous daily and overall loss limits, traders need reliable prop firm limiter tools to automate compliance, protect capital, and sustain consistent performance.

The prop trading risk control software market is projected to grow at 12.4% annually until 2028, reflecting the increasing demand for precision trading control.

5 Essential Prop Firm Limiter Software

These five advanced solutions are purpose-built for traders aiming to stay within firm rules, prevent exceeding loss thresholds, and focus on profitable strategies. In this article, we’ll introduce:

- Prop Firm Capital Protection Expert

- Prop Firm Friendly Range Breakout EA

- WmaTrend Pro Prop Firm Ready MT5 EA Audusd

- Trade Panel Prop Firm Drawdown Limiter Pro MT5

- Prop Firm DrawDown Guard MT5

Prop Firm Capital Protection Expert

The Prop Firm Capital Protection Expert by TradingFinder is a comprehensive risk control suite tailored for professional traders seeking to pass evaluations and retain funded accounts.

Used by prop traders managing $50k–$200k accounts, it combines automation, compliance, and flexibility to handle volatile markets and complex strategies.

Download links:

· Prop Firm Capital Protection Expert For MT4 (Download MT4 Version)

· Prop Firm Capital Protection Expert For MT5 (Download MT5 Version)

Key features:

- Daily and total drawdown control: Enforces exact percentage or dollar-based limits, instantly stopping further losses when triggered;

- Trade volume & frequency restrictions: Prevents over-leveraging by limiting the number and size of trades per day or session;

- News event blocking: Suspends trading before and after high-impact events on the economic calendar;

- Profit/loss suspension triggers: Halts trading for the day once target profits or maximum losses are reached;

- Dynamic position sizing: Calculates lot size based on available equity, chosen risk %, or fixed pip value;

- Multi-symbol monitoring: Oversees all active instruments to manage correlated risk exposure.

You can read more about the mentioned tool on the TradingFinder website.

Prop Firm Friendly Range Breakout EA

The Prop Firm Friendly Range Breakout EA, priced at $120 USD with a $50/month rental option, is designed for traders targeting short-term volatility breakouts while staying compliant with prop firm rules.

- Smart risk management: Uses base money and fixed lot calculations to adapt risk to account size;

- Daily trade closure: Automatically closes all trades at a set daily time to lock in profits and reset exposure;

- Order flooding prevention: Limits the number of simultaneous trades to prevent server overload and excessive risk;

- Configurable breakout hours: Let traders select optimal market sessions for breakout attempts;

- Drawdown monitoring: Monitors equity in real time to maintain alignment with prop firm restrictions;

- Multi-strategy compatibility: Works for both range breakouts and trend-following adaptations.

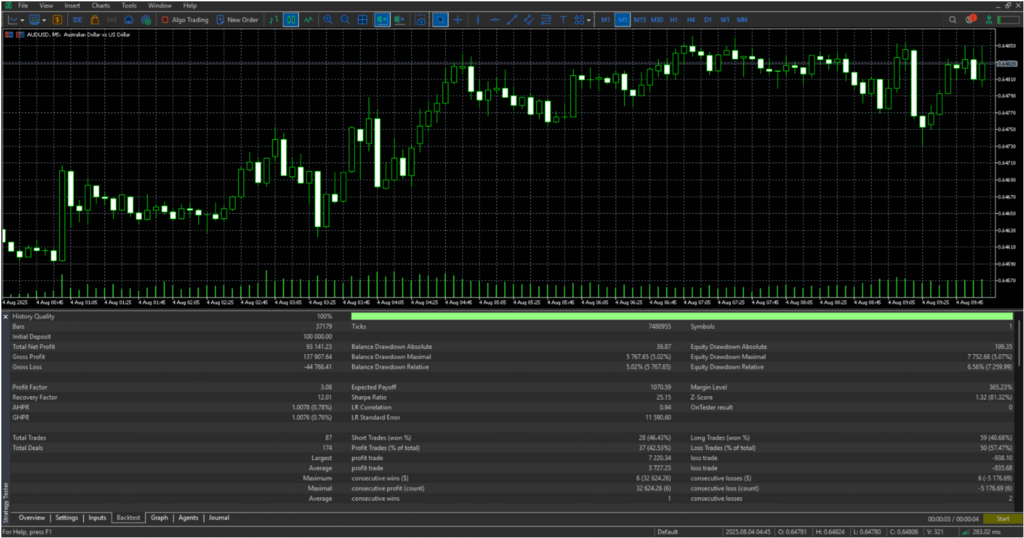

WmaTrend Pro Prop Firm Ready MT5 EA Audusd

At $349 USD, the WmaTrend Pro EA is optimized for AUDUSD on the M5 timeframe, delivering a high reward-to-risk ratio with minimal drawdown.

Backtested on $100k challenge accounts, it integrates prop firm constraints directly into its logic for seamless compliance.

- High reward-to-risk ratio: Generates average wins that are 3.7x larger than average losses, significantly boosting the probability of passing funded account challenges while maintaining low equity volatility;

- Session-specific trading: Executes trades exclusively during the Australian and Asian market sessions, leveraging consistent volatility patterns for optimal trade setups;

- Built-in prop firm rules: Automatically enforces both daily and total drawdown caps, eliminating the risk of unintentional violations;

- Optional daily target: Stops all new trades once profit goals are achieved, effectively locking in gains and preserving psychological discipline;

- Hedging flexibility: Fully operational in both hedging and non-hedging account structures, making it adaptable for a wide range of broker environments;

- Proven backtested performance: Demonstrates months of consistent profitability with equity curves that reflect stability and minimal drawdown.

Trade Panel Prop Firm Drawdown Limiter Pro MT5

The Trade Panel Prop Firm Drawdown Limiter Pro MT5, priced at $110 USD, is an advanced order execution and risk control tool designed for Forex, stocks, indices, and crypto markets. It enables traders to maintain compliance while maximizing trade efficiency.

- Layered stop-loss/take-profit settings: Configure multiple TP/SL levels within a single trade to facilitate staged exits and partial profit-taking strategies;

- Symbol-specific control: Assign distinct risk profiles, margin limits, and position caps for each instrument to manage exposure across diversified portfolios;

- Time-based trade restrictions: Automatically block trades outside pre-set active hours to prevent overnight or off-session risks;

- Break-even modes: Dynamically move stop-loss to the entry point once profit targets are reached, converting positions to risk-free status;

- Strategy versatility: Supports scalping, day trading, and swing trading, with settings that can be fine-tuned for each style;

- Prop firm compliance engine: Runs continuous risk checks to ensure trades meet strict evaluation rules and prevent accidental breaches.

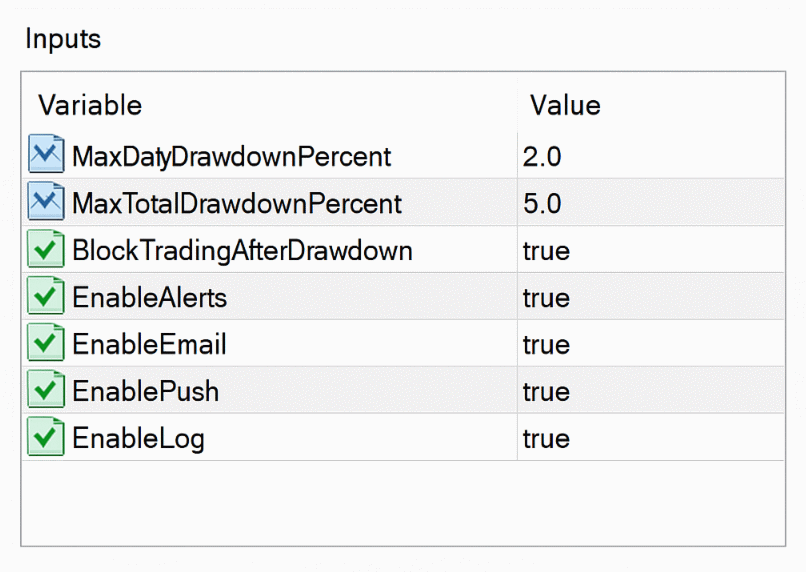

Prop Firm DrawDown Guard MT5

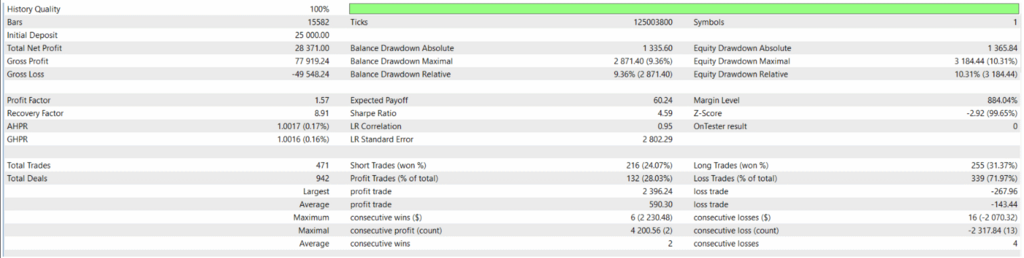

Priced at $49 USD, the Prop Firm DrawDown Guard MT5 by Branko Balog offers simple yet powerful drawdown and trading suspension controls for traders of all experience levels.

- Daily drawdown enforcement: Monitors equity in real time and halts all trading activity once daily loss limits are reached, protecting capital;

- Total drawdown cap: Sets a hard limit on maximum equity loss from the account’s peak, ensuring long-term sustainability;

- Position closure on breach: Immediately closes all open trades when any drawdown limit is hit, preventing further losses;

- Daily trade blocking: Disables new order placement for the rest of the day after a daily limit is breached, reinforcing discipline;

- Multi-channel alerts: Send instant notifications through email, push alerts, and platform pop-ups to keep traders informed;

- Universal market compatibility: Functions seamlessly across all asset classes, including Forex, commodities, indices, and cryptocurrencies.

Conclusion

In the competitive arena of funded trading, where over two-thirds of account failures (68%+) stem from breaching daily or total drawdown rules, risk management isn’t optional; it’s the deciding factor between long-term profitability and early disqualification.

The five prop firm limiter tools outlined here provide traders with an arsenal of features: from multi-symbol equity tracking and percentage-based drawdown caps to automatic position closures, news event trading blocks, and time-based execution restrictions.

For traders managing accounts in the $50,000 to $200,000 range or those aiming to pass high-stakes evaluations from leading firms like FTMO and The Funded Trader, these solutions are designed to automate compliance while enhancing strategic consistency.

The combination of real-time monitoring, customizable safeguards, and multi-channel alerts ensures you stay focused on high-quality trade setups rather than worrying about breaching firm rules.

FAQs

1. What is a prop firm limiter tool?

A software or EA that enforces risk parameters, such as drawdown and position size limits, to ensure compliance with prop firm rules.

2. Can prop firm limiter tools guarantee I pass a challenge?

No tool can guarantee success, but they reduce the risk of failure due to rule breaches.

3. Are prop firm limiters compatible with all brokers?

Most are designed for MetaTrader 5 and 4 and are compatible with common MQL5 brokers.

4. Do they work for manual and automated trading?

Yes, many support both, allowing flexibility in strategy execution.

5. Which limiter tool is best for beginners in prop firms?

The Prop Firm DrawDown Guard MT5 is affordable, easy to configure, and effective for new traders.

Sources: TradingFinder, MQL5