The biopharmaceutical companies and hospitals & clinics landscape involve in gene therapy are rapidly growing as biotech companies join forces with pharmaceutical giants to advance their developments through late-stage processes and commercialize their products while venture capital investment shows continuous growth.

The gene therapy undergoes major transformation as generative AI speeds up both research as well as development and production activities. The growing adoption of gene therapies depends on generative AI as a fundamental innovation driver which both shortens market entry time and decreases expenses and enhances therapeutic success.

Key Growth Drivers and Opportunities

The Expanding Gene Therapy Pipeline: The rising number of therapies advancing through clinical trials for rare diseases along with cancer and neurological disorders leads to heightened investor confidence and increased industry activity. The growing pipeline demonstrates strong innovation which boosts the chances of new approvals thus accelerating the market’s overall expansion.

Challenges

Limitations that are faced by the gene therapy market include the high costs and access barriers disrupts gene therapy market expansion. For instance, according to Novartis AG, a single dose of Kymriah, the therapy cancer drug costs a whopping USD 475,000. The same drug is priced at USD 306,000 in Japan.

Innovation and Expansion

Myrtelle Launches Manufacturing of First-in-Class Gene Therapy for Canavan Disease in Strategic Alliance with Charles River and Viralgen

In July 2025, Myrtelle Inc., a pioneering clinical-stage gene therapy company dedicated to revolutionizing treatment for neurodegenerative diseases, announced the official launch of commercial-stage manufacturing for its first-in-class oligotrophic recombinant adeno-associated virus (rAAV) gene therapy product, developed specifically for Canavan disease (CD).

bluebird bio Announces Completion of Acquisition by Carlyle and SK Capital

In June 2025, bluebird bio, a pioneer in gene therapies for severe genetic diseases, announced the completion of its sale to funds managed by global investment firms Carlyle and SK Capital Partners, LP. Carlyle and SK Capital have provided significant primary capital to support and scale bluebird’s commercial delivery of gene therapies for patients with sickle cell disease, β-thalassemia, and cerebral adrenoleukodystrophy.

Lilly to buy gene-editing partner Verve for up to USD 1.3 billion in cardiac care push

In June 2025, Eli Lilly, announced acquisition of gene-editing startup Verve Therapeutics for up to USD 1.3 billion, accelerating a push into experimental cardiovascular therapies.

The companies were partnering to develop one-time, gene-editing therapies to reduce high cholesterol in people with heart disease, as part of Lilly’s efforts to look beyond its blockbuster weight-loss and diabetes drugs for growth.

Inventive Sparks, Expanding Markets

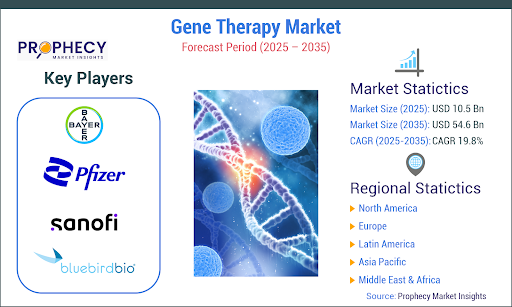

Gene therapy organizations are working to create treatments with a high safety profile, are effective, and offer sustained results by targeting the basic causes of genetic and long-term diseases. Their shared objectives are to improve delivery methods, lower the cost of treatments, increase access globally, and get approval from governing bodies. The key players operating in the gene therapy market include, Bayer AG, Bluebird bio, Inc., Sangamo Therapeutics Inc, VERRA, Orchard Therapeutics, and others.

About Author:

Prophecy is a specialized market research, analytics, marketing and business strategy, and solutions company that offer strategic and tactical support to clients for making well-informed business decisions and to identify and achieve high value opportunities in the target business area. Also, we help our client to address business challenges and provide best possible solutions to overcome them and transform their business.