June 2025 | By Shweta Raskar, Business Development Specialist at Prophecy Market Insights

As the global aerospace industry continues its recovery from pandemic-induced setbacks, a critical yet often overlooked component is ascending to prominence—the Aerospace Coatings sector. These specialized surface treatments are vital not only for aircraft protection and aesthetics but also for improving aerodynamic performance and fuel efficiency.

With global air traffic returning to pre-pandemic levels and airline fleets expanding rapidly, the aerospace coatings domain is poised for significant growth through 2035. Innovations in sustainable materials, nanotechnology, and smart functionalities are expected to propel developments across both commercial and military aviation.

Elevating Aircraft Performance

Aerospace coatings, including polyurethane, epoxy, and ceramic-based solutions, are engineered to endure the harshest environments—UV radiation, corrosion, high-altitude temperatures, and rain erosion. Beyond protective benefits, these coatings also enhance aircraft appearance and reduce drag, directly contributing to improved fuel economy.

The sector supports a diverse range of airframes, from commercial airlines and military jets to helicopters and private planes. Increasing demands for lightweight, long-lasting, and eco-conscious solutions are leading original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) firms to adopt next-generation coating technologies.

Driving Forces Behind Sectoral Growth

- Fleet Modernization and OEM Production

Major aircraft producers such as Boeing, Airbus, and Embraer are ramping up output to accommodate growing air travel needs. As new aircraft enter service and aging fleets require upkeep, demand for high-performance coatings—both for exterior durability and interior quality—is rising. - Fuel Efficiency Imperative

Airlines are under mounting pressure to reduce their environmental footprint. Coatings that minimize surface roughness and maximize aerodynamics help airlines lower fuel consumption, meeting both environmental mandates and cost-reduction goals. - Rising Military Investment

Defense departments worldwide are boosting spending on aerial capabilities. Military aircraft often require specialty coatings offering radar absorption, chemical resistance, and thermal control, stimulating innovation and procurement in the defense domain. - Brand Identity and Luxury Finishing

As air carriers vie for passenger loyalty, customized livery and high-end cabin aesthetics are becoming essential. Coatings that maintain gloss, resist fading, and ensure smooth finishes are in high demand for both branding and passenger experience enhancement.

Segmentation and Technological Evolution

Coating technologies are evolving rapidly. Resin types such as polyurethane dominate due to UV resistance, while epoxies serve as widely used primers. Newer formats, including water-based and powder coatings, are gaining popularity amid environmental regulations.

Applications span external fuselage protection, engine coating, and interior finishing. Aircraft types include commercial, military, and general aviation, with end users divided between OEMs and MRO providers.

Regional Outlook

- North America leads the aerospace coatings landscape due to the presence of top-tier aircraft manufacturers and defense contractors. The U.S. also spearheads R&D in stealth and thermal-insulating coatings.

- Europe remains focused on environmentally friendly innovations. With Airbus headquartered in the region, Europe is pivoting toward low-VOC and waterborne solutions in response to strict regulations.

- Asia Pacific emerges as the fastest-growing region, buoyed by rising air travel, regional airline expansion, and investments in domestic aviation infrastructure in countries like China and India.

Emerging Trends and Challenges

Technological advancements continue to shape the sector:

- Eco-friendly coatings aim to reduce environmental impact, aligning with REACH and EPA guidelines.

- Smart coatings are being developed to detect corrosion, change color with heat, or self-heal, improving safety and maintenance efficiency.

- Nano-coatings offer ultra-thin layers with enhanced abrasion, anti-static, and de-icing properties.

Despite the promising outlook, challenges remain. The complexity of aerospace-grade certification, fluctuating raw material prices, and the need for skilled labor in coating application pose barriers to rapid adoption.

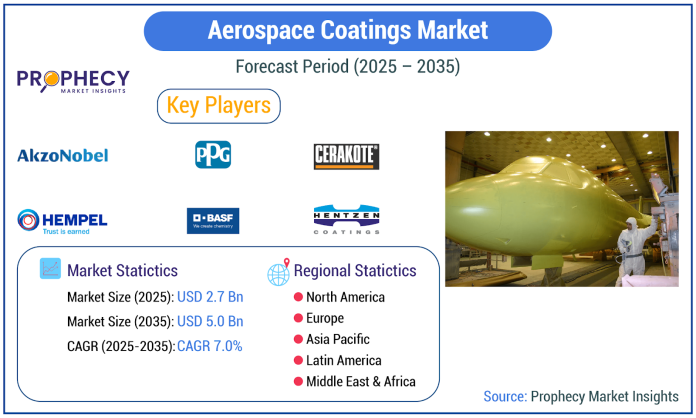

Competitive Landscape

Key players include:

- PPG Industries

- AkzoNobel

- Sherwin-Williams

- Hentzen Coatings

- Axalta Coating Systems

- Mankiewicz Gebr. & Co.

- Zircotec

- Henkel AG

These companies are investing heavily in sustainable innovations, OEM partnerships, and high-performance materials to maintain leadership positions.

Looking Ahead

The aerospace coatings industry is set for steady ascent, powered by global aviation recovery, defense modernization, and material science breakthroughs. Emerging segments such as eVTOL (electric vertical take-off and landing aircraft), UAVs (unmanned aerial vehicles), and space missions are expected to expand the scope and complexity of the sector further in the years ahead.

About Us:

Prophecy Market Insights is a leading provider of market research services, offering insightful and actionable reports to clients across various industries. With a team of experienced analysts and researchers, Prophecy Market Insights provides accurate and reliable market intelligence, helping businesses make informed decisions and stay ahead of the competition. The company’s research reports cover a wide range of topics, including industry trends, market size, growth opportunities, competitive landscape, and more. Prophecy Market Insights is committed to delivering high-quality research services that help clients achieve their strategic goals and objectives.